Our areas of trading and investment avenues (not limited to)

Purchasing crypto for long term holdings to capitalize on value appreciation

Taking advantage of the volatility of Crypto assets making shorter term moves

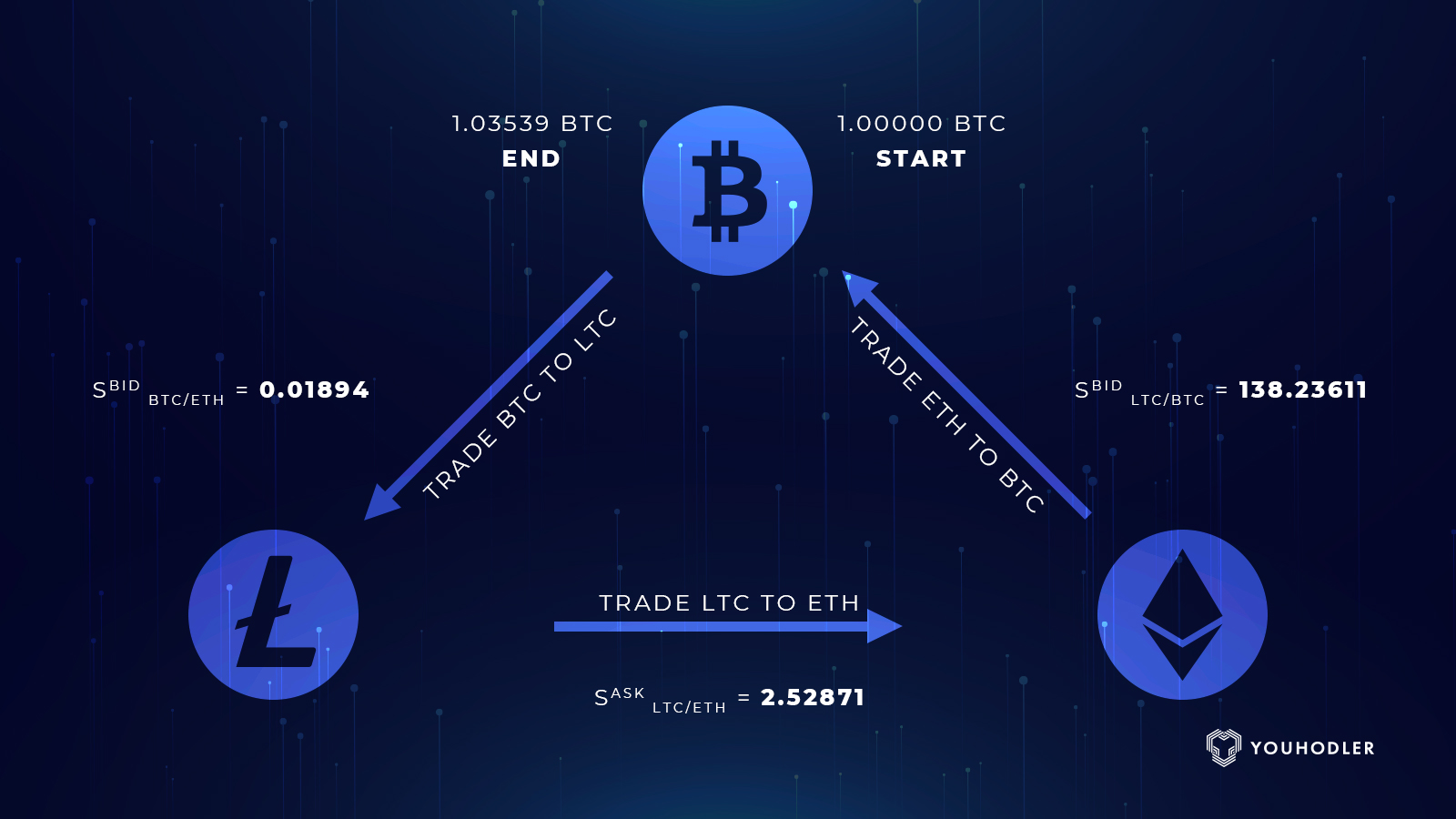

Opportunities from basic buy/sell to more advanced statistical arbitrage

Multiple strategies bring needed diversification to achieve more consistent results and better protection for single asset outlier risk

DetailsLook to buy and sell option premium against underlyings that have gone outside their normal volatility ranges. With the standard held belief that volatility reverts to the mean, consistent income can be generated through trading elevevated or depressed option premiums

Short term trading of futures can provide exposure to trend following and mean reverting systems. Commodity futures are a focus as they are heavily reliant on supply/demand issues which can be evaluated more efficiently through the use of data analysis

New and emerging markets tend to show higher volatility than established markets. Crypto currencies are no exception showing very high volatility. This volatility allows for short term trading of the assets when the conditions are correct.

Both technical and Fundamental analysis are used on most strategies to offer a balanced approach. Using machine learning and other data analytic tools allows for more informed decisions to be made and a quantitative aspect to risk management.

GB Data & Analysis

Released Research Reports

Assets Tracked

Through our diversified trading and investment approach 5MWC has grown and continues to grow through both bull and bear markets