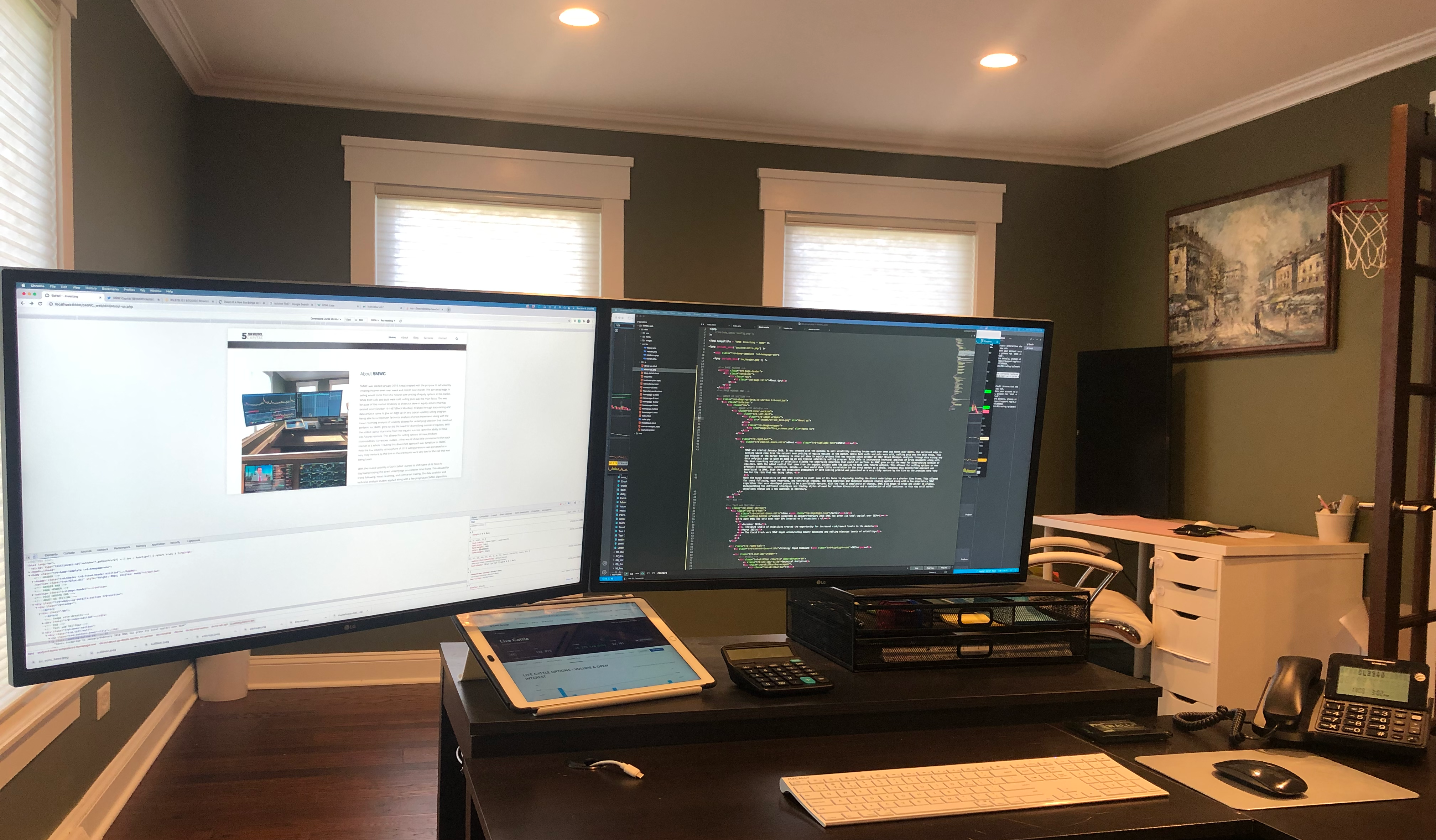

About 5MWC

5MWC was started January 2018. It was created with the purpose to sell volatility creating income week over week and month over month. The perceived edge in selling would come from the natural over pricing of equity options in the market. While both calls and puts were sold, selling puts was the main focus. This was because of the market tendency to show put skew in equity options that has existed since October 19 1987 (Black Monday). Analysis through data mining and data anlytics came to give an edge up on any typical volatility selling program. Being able to incorporate Technical analysis of price movements along with the mean reverting analysis of volatility allowed for underlying selection that could out perform. As 5MWC grew so did the need for diversifying outside of equities. With the added capital that came from the organic success came the ability to move into futures options. This allowed for selling options on new products (commodities, currencies, metals...) that would show little correlation to the stock market as a whole. Creating this diversified approach was beneficial to 5MWC. With the low volatility atmosphere of 2019 selling premium was perceived as a very risky venture by the firm as the premiums were very low for the risk that was being taken.

With the muted volatility of 2019 5MWC started to shift some of its focus to day/swing trading the direct underlyings on a shorter time frame. This allowed for trend following, mean reverting, and contrarian trading. The data analytics and technical analysis studies applied along with a few propriatary 5MWC algorithms that were developed proved to be a profitable venture. With the rise in popularity of cryptos, 5MWC also began to trade and invest in cryptos. Incorporating the different strategies and trading styles allowed for maximum diversification and a combination of all continues to this day until market conditions change and a new approach is necessary.

Some Facts

Since inception in January/February 2018 5MWC has grown its total capital over 183%

To date 5MWC has only been over 80% invested on 2 occassions :

- December 2018

- - Elevated levels of volatility created the opportunity for increased risk/reward levels in the market

- March 2021

- - The Covid Crash. 5MWC began accumulating equity positions and selling premium in elevated levels of volatility